A Welcome Relief at the Pump: Dangote Signals a Market Shift

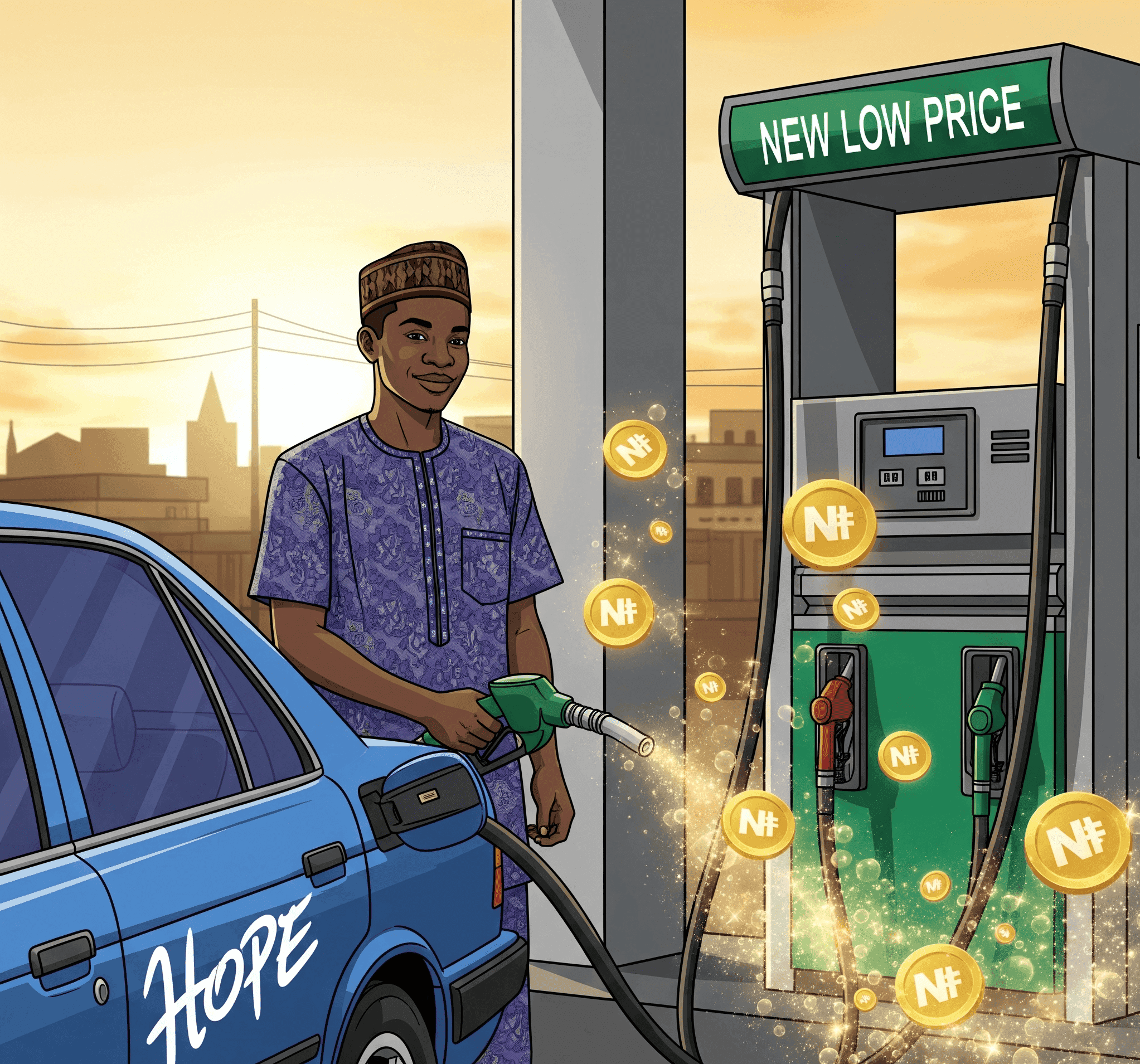

For millions of Nigerians grappling with a persistent cost-of-living crisis, a recent announcement has offered a rare glimmer of economic relief. On August 12, 2025, the Dangote Petroleum Refinery, a behemoth in Nigeria's energy landscape, declared a significant reduction in the ex-depot price of Premium Motor Spirit (PMS), commonly known as petrol. The refinery slashed its gantry price from ₦850 to ₦820 per litre, a direct cut of ₦30. This move, confirmed in a statement by the Dangote Group's Chief Branding and Communications Officer, Anthony Chiejina, was framed as part of the company's "unwavering commitment to national development" and included an assurance of a "consistent and uninterrupted supply" of petroleum products to the nation.

This price adjustment is not merely a routine fluctuation; it represents a potential turning point in a period of severe economic strain. Since the landmark removal of fuel subsidies in 2023, Nigerians have faced a relentless upward march in fuel prices, which has been a primary driver of hyperinflation. An SBM Intelligence report from early 2025 painted a stark picture of the situation, revealing a staggering 69.9% increase in petrol costs over the preceding year alone. This surge in fuel prices has had a devastating ripple effect across the economy, contributing to Nigeria's inflation rate soaring to 33.2% in 2024, a near 30-year high. The report poignantly noted, "The cost of petrol is no longer just about fueling cars; it's fueling inflation, poverty, and economic instability".

Against this backdrop, Dangote's price reduction is more than just a welcome discount. In the fluid, newly deregulated downstream sector, the refinery's pricing decisions carry immense weight. As the single largest domestic producer, its ex-depot price effectively sets a benchmark that influences the entire market. By publicly announcing a price decrease, Dangote is not simply selling cheaper fuel; it is actively shaping market expectations and compelling competitors to adjust their own pricing strategies. This action signifies a critical evolution in Nigeria's fuel market—a transition from a historically government-controlled price regime to one where a dominant market leader's strategic moves can dictate the direction of prices for the entire industry.

The Domino Effect: How the ₦30 Cut is Rippling from the Depot to the Pump

The true measure of Dangote's price adjustment lies in its tangible impact on the wallets of everyday Nigerians. The ₦30 reduction at the gantry level has triggered a swift and observable chain reaction, with retail filling stations across the country beginning to lower their pump prices in response. This domino effect provides a clear illustration of how changes in the wholesale market translate directly into consumer savings.

The most immediate and significant response came from the Nigerian National Petroleum Company Limited (NNPCL). Its retail outlets in the Federal Capital Territory, Abuja, which had been selling petrol at ₦945 per litre, promptly reduced their price to ₦890 per litre. This substantial ₦55 cut demonstrates the NNPCL's new role as an active competitor in the market, compelled to react to the pricing strategies of other major players.

Independent marketers have also followed suit. An MRS Filling Station manager in Abuja confirmed that their outlets received a directive to reduce the pump price from ₦915 to ₦885 per litre, a ₦30 decrease that directly mirrors the cut made by Dangote. Similarly, other stations like Empire Energy adjusted their prices downward to ₦946 per litre to attract customers in a newly competitive environment. Market analysts project that this trend will be felt nationwide, with pump prices in Lagos and its environs, which had recently climbed above ₦900, expected to stabilize around ₦865 to ₦875 per litre.